The checkout crisis that taught us everything about customer trust

The checkout crisis that taught us everything about customer trust

A 3-point drop in conversion. Rising complaints. A payment page users didn’t trust. Here's how we turned things around—and what you can learn from it.

- 30 May 2025

- ⋅

- 4 min read

The Quiet Decline That Nearly Broke Our Checkout

At first, it looked like a minor blip.

As CX/UX Product Manager at a fashion e-commerce group, I noticed a 0.8-point drop in our conversion rate at the final step of the checkout. It wasn’t dramatic—but it was persistent.

In e-commerce, a slow bleed is worse than a sudden break. That dip translated into tens of thousands in lost revenue each month—and, more importantly, signaled a growing customer experience issue in our most sensitive touchpoint: payment.

We needed to act fast.

The Cross-Functional Task Force That Saved the Funnel

We formed a "Payment SWAT team"—a collaboration between Product, Tech, and our PSP—to hunt down the source of the friction.

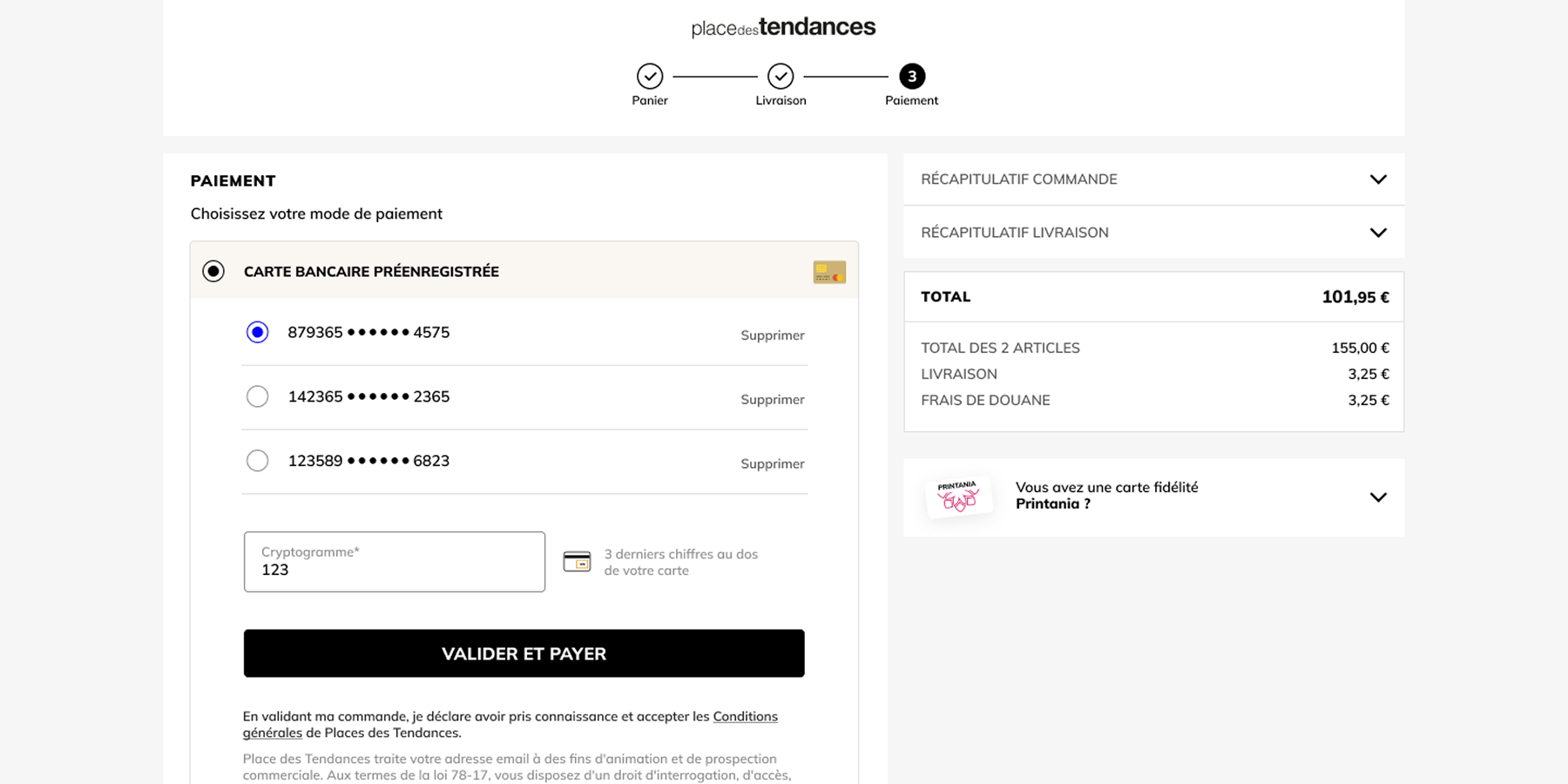

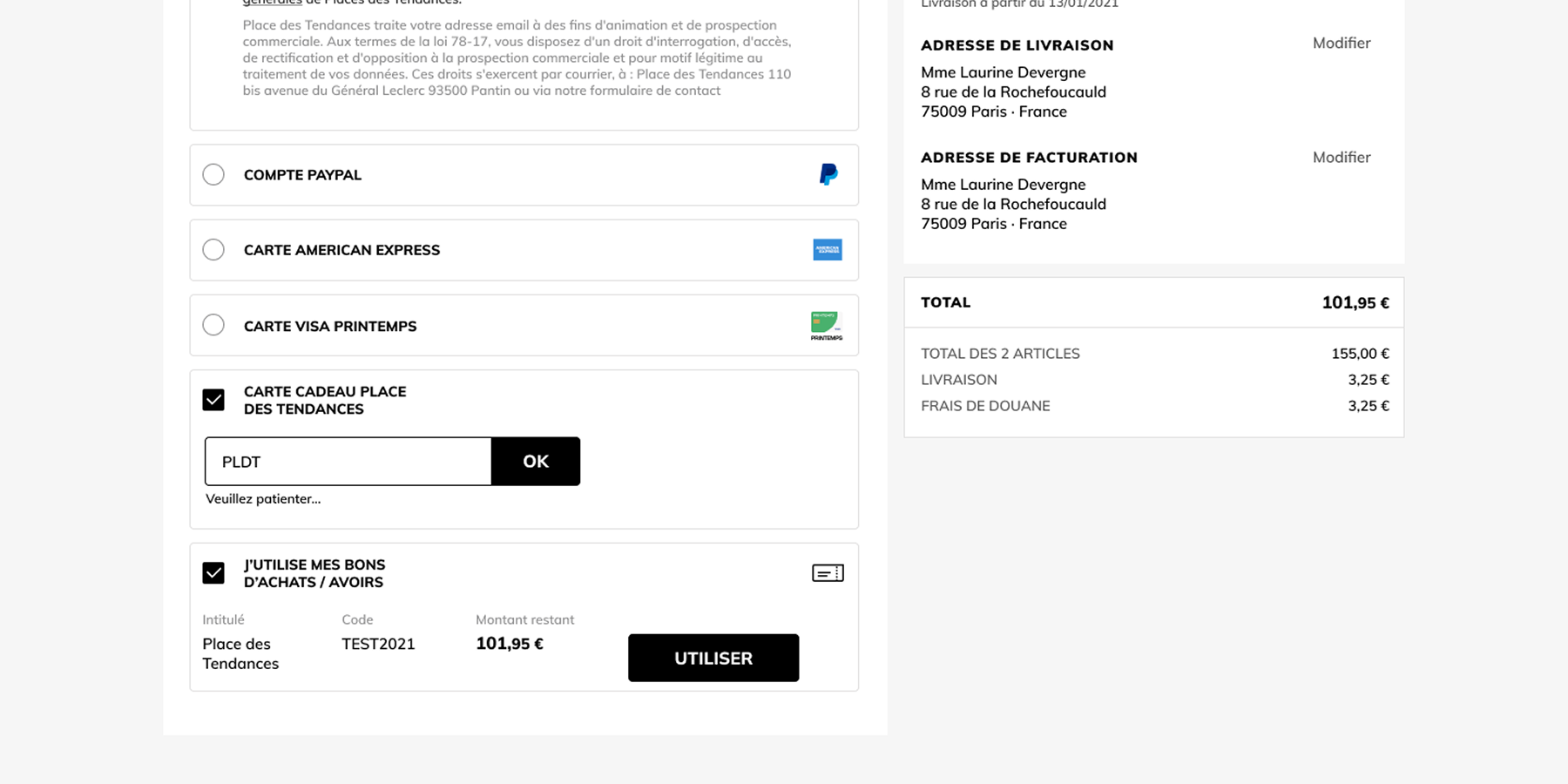

We ran two parallel investigations:

- Behavioral analytics deep-dive (user journey recordings, support feedback, analytics)

- Technical diagnosis (PSP logs, server error tracking, legacy data review)

The results exceeded our fears.

From friction to familiarity: Localized currencies, languages, and UX cues built trust — and conversions.

What the Data Told Us (And What Our Customers Were Silently Screaming)

- Customers spent 25% more time on the payment page than normal

- Many users were looping back to payment after validation

- Session recordings showed growing post-failure confusion

- Support was flooded with messages like: “I thought my card was hacked.”, “I gave up after the third try.”

This wasn’t buyer hesitation — it was a trust crisis triggered by technical glitches and unclear guidance.

The Technical Reality Behind the Mess

Our payment process was breaking down quietly behind the scenes :

- 3D Secure failures due to a PSP/server sync issue

- Intermittent 500 errors hard to reproduce

- Outdated customer data being sent to banks (like unused landlines)

- A poorly-timed Ingenico upgrade that throttled 3DS performance

Customers were hitting an invisible wall—then getting no help climbing over it.

Our Playbook : Fixing the Flow, Fast

✅ Quick Wins (First 2 Weeks)

- Cleaned up invalid data fields in our payment form

- Enabled auto-fill and ID tokens to reduce 3DS steps for return users

- Rewrote system errors into human-readable messages like:

“This card was declined. Please try another or contact your bank.”

🧱 Long-Term Foundation

- Planned a progressive migration to Adyen, starting with 5% of new users

- Built a flexible iframe-based checkout to decouple from legacy dependencies

- Benchmarked UX flows from high-end competitors to redesign our form

What Changed—And Why It Mattered

Within weeks, we saw measurable improvements:

Your payment experience is your brand's final handshake—make sure it feels confident, not clumsy

What We Learned (So You Don’t Have To)

- Test PSP Migrations Gradually

What works in staging never works exactly the same in prod. Start small. Monitor. Expand carefully. - Enrich Data to Reduce Friction

Returning users shouldn’t have to jump through the same hoops. Smarter data = higher conversion. - Bad Error Messages Destroy Trust

Generic messages confuse. Helpful ones retain customers even when things fail. - Payments Deserve Ongoing Attention

We now run monthly Payment Health Reviews tracking 3DS performance, refusal rates, and form UX metrics.